The Bureau of Internal Revenue (BIR) is reminding all candidates and political parties who ran in the 2025 elections that they are subject to tax regulations and must comply with key requirements as part of their duties as candidates for public office.

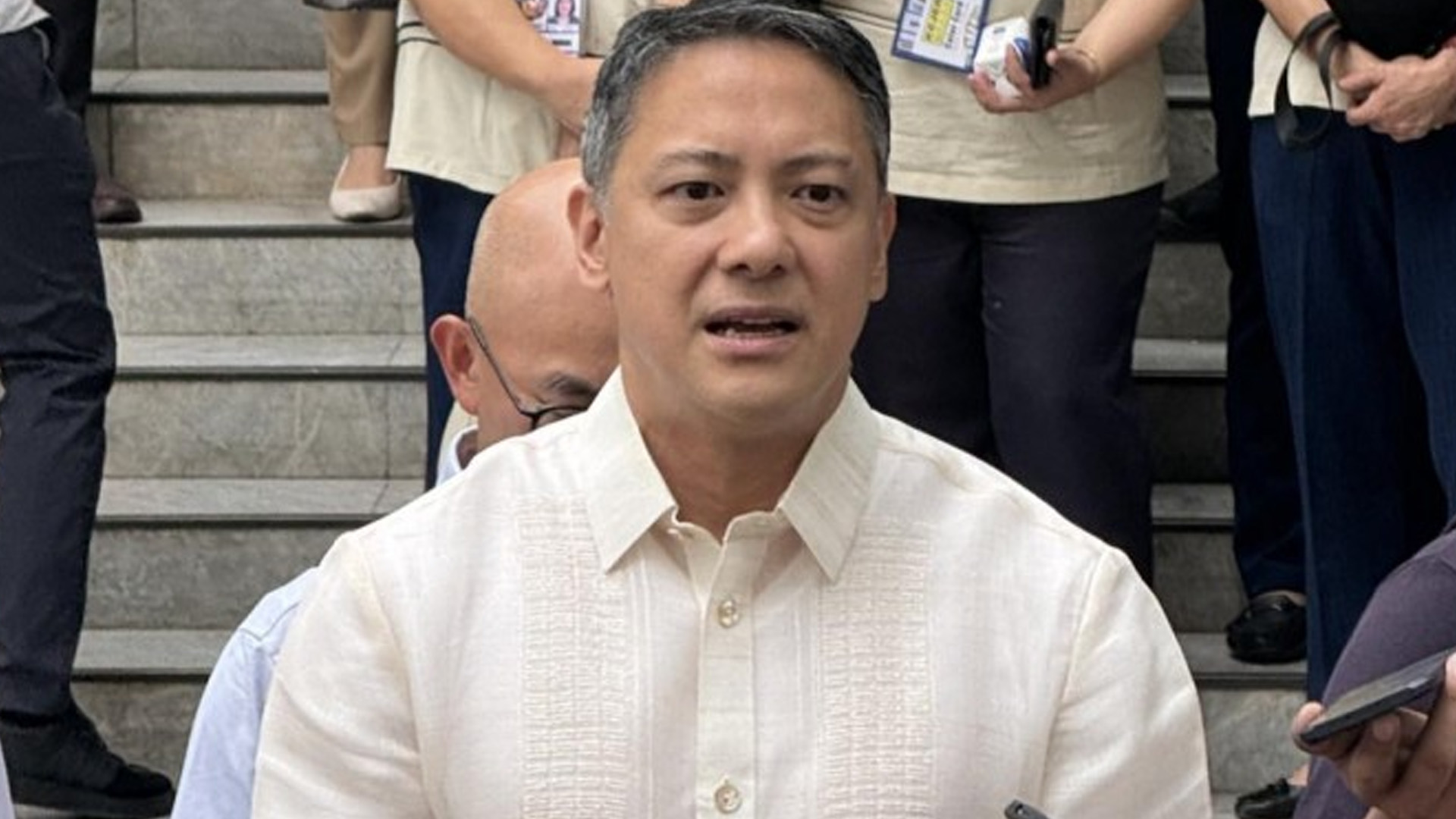

In a television interview, BIR Commissioner Romeo Lumagui Jr. emphasized that all candidates and political organizations, including party-list groups must issue BIR-registered invoices for contributions they receive, whether in cash or in kind.

“At pag nagbabayad sila sa kanilang mga suppliers ay kinakailangan nilang mag-withhold ng 5 percent dun sa kanilang suppliers (They also need to withhold 5 percent when they pay to their suppliers),” he said, as quoted in a news release on Thursday.

He added that candidates must keep track of their expenses and submit detailed reports, or Statement of Contribution and Expenditure (SOCE), not just to the Commission on Elections but also to the BIR.

“Para makita natin na lahat kung compliant ang kanilang obligasyon dito (This is for us to determine if everybody is compliant with their obligations),” he said.

Lumagui further reminded that while candidates and parties are allowed to keep excess campaign contributions, they need to pay taxes on these.

“Pagka sobra naman ang natanggap nila na mga contributions sa mga ginastos nila, kinakailangan nilang bayaran ang income tax patungkol dito sa sobrang natanggap nila (If the contributions they received are more than what they spent, they need to pay income tax on the excess funds).”

Lumagui warned that candidates and parties who fail to comply with these requirements could face tax evasion charges.

“In certain cases, non-compliance may even serve as grounds for disqualification,” he added. (PNA)